Risk Foresight: Strategic Resilience in the Age of Multiple Risks

We are experiencing an age of multiple risks, an age of higher frequency and stronger impact of concurrent risks. And whether you want to call it ‘polycrisis’, ‘just history’ or assume risk synchronizing, it is all of our business. The world is moving faster, perceived as more brittle, uncertain, complex and incomprehensible. Risks are realizing faster, more often and become more connected and severe. Five underlying forces contribute to this notion. Now it is time to conduct a holistic stress test on multiple risks that account for the peculiarities of each organization.

• Interconnectedness and speed increase complexity and exposure: People, companies, data and things are evermore connected, global value chains are reconfiguring, and industries increasingly converge. As a result, the potential points for interactions, cascade effects and disruption grows. It is becoming more challenging to anticipate risks and react in a timely manner.

• Accumulated centralization can turn into a liability. The socio-economic and technological fabric are characterized by spatial concentration, which can turn out to be a vulnerability and bottleneck when risk impacts unfold. For instance, urban areas are economic centers and home to an increasing number of people, energy systems are centralized, monocultures dominate arable lands and network effects shape digital markets. Gradual impacts or a disruption can have severe impacts for affected area or actor and trickle down to others.

• Lasting and irreversible changes to the environment threaten to introduce a new risk reality. Part of this reality are climate extremes, rising and more acidic oceans, more intense storms, and a loss of species, which equals a loss to learn from nature. Anthropogenic changes go beyond our planet, they are even present in space in form of evermore objects and cascading debris.

• A contested and fragmented world destabilizes established orders and shared ideas. Competition between political systems and social divisions threaten to destabilize established processes and shared views, thereby triggering upheavals and making it harder to settle for common grounds.

• Digital and sustainability transformations can pose their own unintended risks. For instance, resource efficiency gains could provide a false sense of security and backfire. There is no alternative to act on environmental, social and governance issues. Thus, analyzing unintended consequences of such transformations will be key to identify corresponding solutions.

The multifaceted risk landscape requires a deep dive by organizations.

Many institutions like the World Economic Forum, European Parliamentary Research Service or Existential Risk Research Assessment identified global risks with potential far reaching impacts on all sectors and actors. Global risks span across all sectors that shape our world: society, technology, environment, economy and politics.

Z_punkt identified 17 risks and a subset of projections for each risk through a meta-study and foresight tools, like weak signal scanning, and by applying creative and systems thinking. These 17 risks need to be considered, analyzed, enriched and elaborated further depending on the individual requirements and perspectives of each organization. While degrading qualities of resource deposits or a far-reaching crop disease pandemic might be perceived as the most pressing risks by some, for others it might be a digital pandemic or a financial crisis resulting from a fossil carbon bubble. However, in a more complex and brittle world, it is not sufficient to explore only parts of the risk landscape, only one sector or only one risk in isolation.

Fig. 1: Overview of 17 global risks (Source: Z_punkt GmbH 2023)

It is crucial to explore risks, their potential cascades and multiplying consequences. Those may arise from risks that appear isolated or insignificant at first.

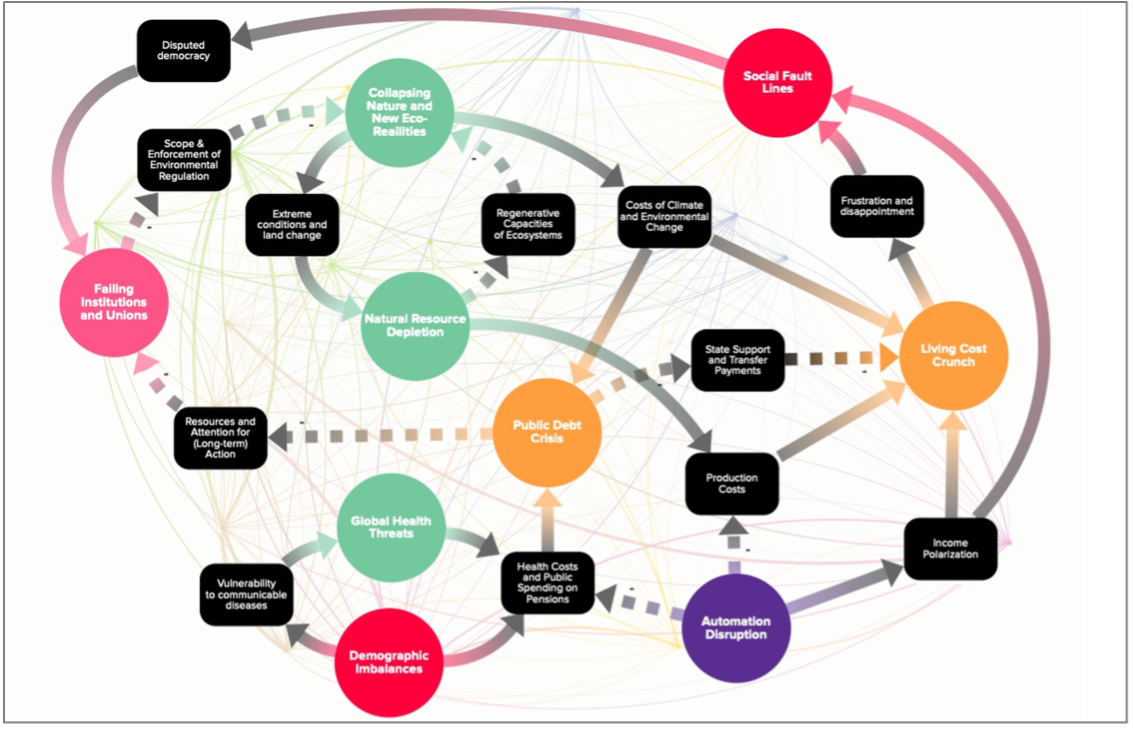

One can view risks through three lenses: as lingering risks, structural risks, or as sudden shocks. Lingering risks, like desertification, build up over time and are influential, even though they might not be on the agenda or under the radar yet. Structural risks, like power concentration, in digital markets are inherent within a specific context, they arise from inert structures, mechanisms, or other foundational elements of systems. Shocks, like the outbreak of a digital pandemic, are sudden shifts and events that disrupt systems, the status quo and way of doing things. All types of risks are interconnected, they can drive or restrain each other. Importantly the impacts of risks can multiply. With that mind, unfamiliar risks, risks that stem from another industry and risks that are not immediately apparent or are regarded as having only indirect effects can have severe consequences. This becomes evident by mapping the causal relationships of risks, and the impacts on one’s organization and key stakeholders. The simultaneous impacts and interdependence of risks underscore the need for a 360-degree perspective and forward-looking approach to risks.

Fig. 2: Example of a Risk Impact Analysis (Source: Z_punkt GmbH 2023)

The age of multiple risks challenges organizations, their established structures and conceptions about resilience.

More severe, dense sequences and simultaneous risk impacts threaten to put existing resilience capabilities to their limits and overstretch the time to recover. It is therefore becoming pressing for organizations to nurture resilience and antifragility as to emerge stronger from adverse situations. No organization is detached from the age of multiple risks, direct and indirect effects of risks have an impact. Indirect effects in the wider business environment and on stakeholders can trickle down in cascades rather sooner than later. Impacts of multiple risks have the potential to introduce new realities, for instance, regarding economic progress, reliability of business partners, value sets and attitudes towards long established technologies. Thus, organizations are tasked to go beyond supply chain resilience and identify strategic options to achieve resilience regarding customers, business partners, skill building, environmental change, their reputation and the portfolio itself. Organizations need to conduct a stress test before cascading and multiplying risks unfold and potentially overwhelm existing capacities and foundations of their business.

Risk foresight is a necessary stress test that enables organizations to evaluate strategic options in the age of multiple risks.

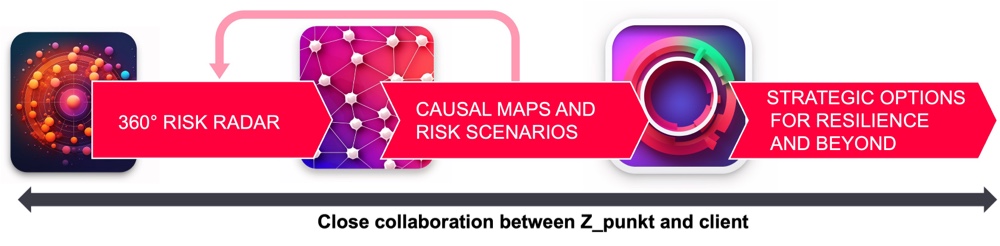

Z_punkt’s approach to risk foresight combines an analytical and creative mindset to identify and understand the key risks of tomorrow as well as strategic options for our clients. Risk foresight operates at the interface of departments, its role goes beyond creating knowledge, risk foresight fosters the strategic dialogue and shared views across the organization. A typical risk foresight project is based on three main steps, individualized processes and brief workshop formats can be developed to meet specific requirements and goals.

1. Understanding the Risks on the Horizon: Our risk radars capture that each organization has unique characteristics and spheres of actions, just like risks do. In our projects, we develop individualized risk radars based on foresight tools like trend analysis, weak signal scanning, wild card imagination and creative workshop formats that support to envision formerly unknown risks. Our risk radars are holistic, they encompass risks related to society, technology, economy, environment and politics. The perception of risks also depends on one’s individual perspective and context. Thus, we evaluate risks from a foresight perspective and our clients evaluate risks from their internal perspective as to uncover blind spots and classify risks on the radar.

2. Mapping the Interactions of Risks in Scenarios: In our foresight practice we put emphasis on story telling with risk scenarios. We leverage digital solutions to illustrate the interactions between risks and our clients in interactive causal maps. Often, our client is involved in this process to aid understanding of risks further. We express the age of multiple risks in so-called risk scenarios, which can be best described as pictures of the future that emerge from lingering, structural and shock risks. In case of inaction, risk scenarios can pose existential business risks to today’s organizations. Risk scenarios facilitate strategic discussions around the question of “what if…challenges us?”.

3. Stress Testing Your Business: Our risk insights are stress tests that challenge the structure and business fields of organizations. Together with our client, we identify strategic options that are relevant for entire organizations and or individual functions, from A like accounting, H like human resources, N like new business development or Z like Zero Waste initiatives. Strategic options portray levers to become more resilient and even come out stronger from adverse impacts. Risk foresight enables organizations also to analyze innovation potentials. Cushioning or even preventing adverse outcomes on stakeholders, like customers and the planet, motivates possible growth fields. For instance, corruption, uncontrolled urbanization and failures of institutions to regulate sand use can lead to shortages and high prices of certain sand types. A company could decide to strengthen its portfolio regarding alternative resources and start to explore digital solutions that enable a circular economy. By doing so, the portfolio becomes more resilient and the company also reduces associated risks of sand mining to local environments like flooding and the destruction of natural habitats.

Fig. 3: Z_punkt Risk Foresight Approach (Source: Z_punkt GmbH 2023)

The age of multiple risks requires a dedicated analysis instead of mere alarmism. Risk foresight serves as the necessary cross-functional stress test exercise for organizations. Our approach allows organizations not only to identify risks across all relevant areas but also to make sense of the interactions between risks and potential existential business risks. With risk foresight, organizations are enabled to be more confident and to take strategic actions for resilience and beyond – a capability that provides an edge in the age of multiple risk.